SG Americas Securities LLC Has $563,000 Position In Floor & Decor Holdings, Inc. (NYSE:FND)

SG Americas Securities LLC raised its stake in shares of Floor & Decor Holdings, Inc. (NYSE: FND – Free Report) by 39.8% in the second quarter, according to its most recent filing with the SEC. The fund owned 5,659 shares of the company’s stock after purchasing an additional 1,610 shares during the period. SG Americas Securities LLC’s holdings in Floor & Decor were worth $563,000 as of its most recent filing with the SEC.

SG Americas Securities LLC raised its stake in shares of Floor & Decor Holdings, Inc. (NYSE: FND – Free Report) by 39.8% in the second quarter, according to its most recent filing with the SEC. The fund owned 5,659 shares of the company’s stock after purchasing an additional 1,610 shares during the period. SG Americas Securities LLC’s holdings in Floor & Decor were worth $563,000 as of its most recent filing with the SEC.

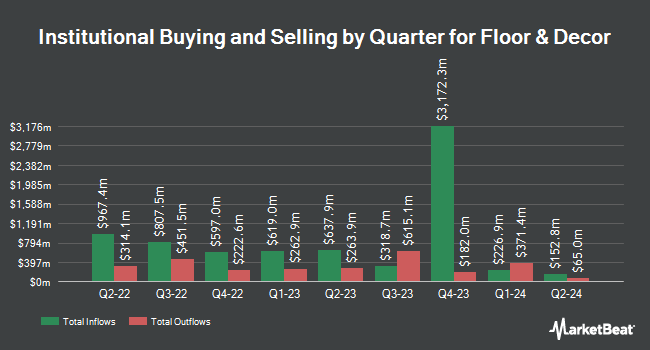

A number of other investors have also made changes to their positions in the stock. Benjamin F. Edwards & Company Inc. lifted its position in shares of Floor & Decor by 4.6% during the first quarter. Benjamin F. Edwards & Company Inc. now owns 2,202 shares of the company’s stock valued at $285,000 after purchasing an additional 96 shares during the last quarter. Vancity Investment Management Ltd raised its position in shares of Floor & Decor by 1.5% during the first quarter. Vancity Investment Management Ltd now owns 7,649 shares of the company’s stock valued at $991,000 after buying an additional 111 shares in the last quarter. Janney Montgomery Scott LLC lifted its position in shares of Floor & Decor by 0.5% during the fourth quarter. Janney Montgomery Scott LLC now owns 23,389 shares of the company’s stock worth $2,609,000 after buying an additional 117 shares in the last quarter. Nomura Asset Management Co. Ltd. lifted its position in shares of Floor & Decor by 2.4% during the fourth quarter. Now Nomura Asset Management Co. Ltd. now owns 5,141 shares of the company’s stock valued at $574,000 after buying an additional 120 shares in the last quarter. Finally, PNC Financial Services Group Inc. increased its stake in Floor & Decor by 1.1% in the fourth quarter. PNC Financial Services Group Inc. now owns 10,709 shares of the company’s stock valued at $1,195,000 after acquiring an additional 121 shares during the period.

Internal Work

In related news, CEO Thomas V. Taylor sold 34,199 shares of the Floor & Decor stock in a transaction on Wednesday, June 12th. The stock sold at an average price of $125.00, for a total sale of $4,274,875.00. Following the completion of the sale, the chief executive officer now owns 168,386 shares of the company’s stock, valued at $21,048,250. The sale was disclosed in an official filing with the SEC, which can be found on the SEC’s website. 2.10% of the stock is currently owned by company insiders.

Analysts Set New Price Expectations

A number of research firms recently weighed in on FND. Evercore ISI lowered their target price on shares of Floor & Decor from $120.00 to $100.00 and set an “in-line” rating on the stock in a research note on Tuesday, July 2nd. Mizuho dropped their target price on shares of Floor & Decor from $115.00 to $110.00 and set a “neutral” rating on the stock in a research note on Friday, May 3rd. . Piper Sandler dropped their target price on shares of Floor & Decor from $115.00 to $95.00 and set a “neutral” rating on the stock in a research note on Friday, August 2nd. Guggenheim dropped their target price on shares of Floor & Decor from $130.00 to $115.00 and set a “buy” rating on the stock in a research note on Friday, August 2nd. Finally, Wells Fargo & Company dropped their target price on shares of Floor & Decor from $125.00 to $95.00 and set an “equal weight” rating on the stock in a research note on Friday, July 26th. Two equities research analysts have rated the stock with a sell rating, thirteen have given a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat, the company presently has an average rating of “Hold” and a consensus price target of $104.37.

Read Our Latest Report on Flooring and Decor

Floor & Decor Stock Performance

Shares of NYSE:FND opened at $107.24 on Tuesday. The company has a current ratio of 1.17, a quick ratio of 0.21 and a debt-to-equity ratio of 0.10. Floor & Decor Holdings, Inc. it has a one year low of $76.30 and a one year high of $135.67. The stock has a market capitalization of $11.48 billion, a P/E ratio of 51.81, a P/E/G ratio of 10.13 and a beta of 1.74. The business has a 50-day moving average of $101.50 and a 200-day moving average of $111.23.

Floor & Decor (NYSE:FND – Get Free Report ) last posted its quarterly earnings results on Thursday, August 1st. The company reported $0.52 EPS for the quarter, topping the consensus estimate of $0.51 by $0.01. Floor & Decor had a margin of 4.78% and a return on equity of 10.85%. The company had revenue of $1.13 billion during the quarter, compared to analysts’ expectations of $1.15 billion. In the same quarter last year, the company earned $0.66 EPS. Floor & Decor revenue was down .2% year over year. Equities analysts predict that Floor & Decor Holdings, Inc. it will post 1.81 earnings per share for the current year.

Flooring & Decor

(Free Report)

Floor & Decor Holdings, Inc. together with its subsidiaries, operates as a multi-channel wholesaler of hardwood flooring and related materials, and wholesalers for commercial locations in Georgia. The company offers tile, wood, laminate, vinyl, and natural stone flooring products, as well as decorative materials, wall tiles, and installation materials and accessories; and vanities, shower doors, bathroom fixtures, faucets, sinks, custom countertops, bathroom mirrors, and bathroom lighting.

Read more

Want to see what FND other hedge funds are holding? Visit HoldingsChannel.com for the latest 13F filings and business insiders for Floor & Decor Holdings, Inc. (NYSE:FND – Free Report).

Get Floor & Decor Daily News and Details – Enter your email address below to receive a concise daily summary of the latest news and analyst ratings for Floor & Decor and related companies with MarketBeat ‘s FREE email newsletter. com.

#Americas #Securities #LLC #Position #Floor #Decor #Holdings #NYSEFND